LALUX Assurances

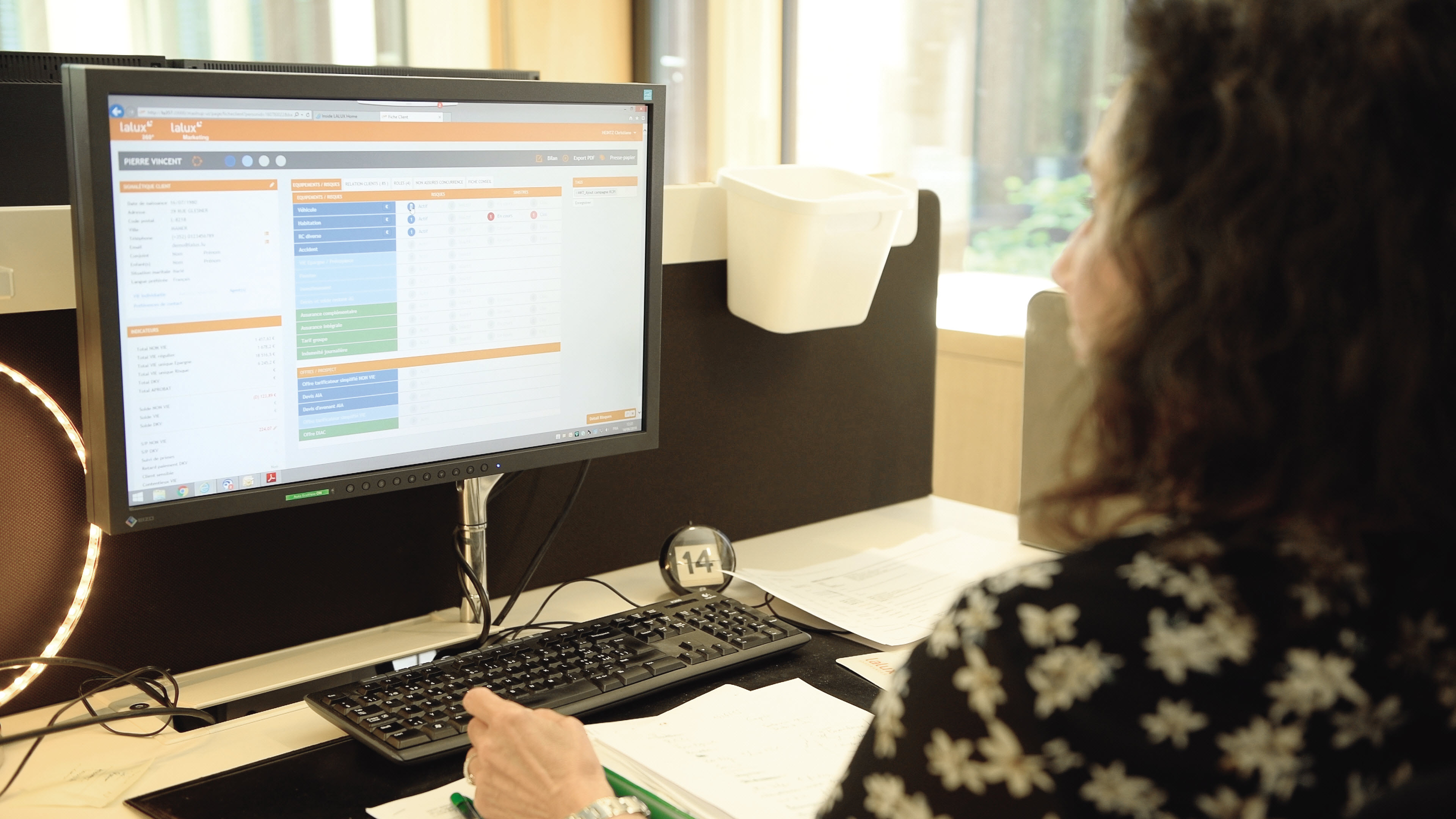

LALUX Assurances wanted to have a consolidated view of customers for all the groups. NETVIBES (formerly EXALEAD) OneCall provides information about customers by aggregating all the data on their activity into a simple and upgradable user interface.

Focusing on customer value

In their sales approach, insurance companies are affected by changes relating to the digital revolution, like most businesses. The main challenge is to respond to the increasingly complex demands of their customers. Consumers, empowered by the benefits of digital technology, are seeking faster, higher-performance and more efficient services. This evolution, combined with growing regulatory surveillance, is tightening the rules for financial activities, especially those concerning insurance products. Introduced in 2018, European regulations—including the Insurance Distribution Directive (IDD)—are designed to strengthen customer protections and harmonize the rules applicable to insurance distributors, regardless of their status. The IDD also ensures the convergence of the rules governing the distribution of life insurance and other investment products.

This series of regulatory changes, initiated in the 2000s, emphasizes the importance of customer value. This trend reflects the philosophy of insurers wishing to exercise their activity responsibly, placing customers at the heart of their marketing strategy. This is the case with LALUX Assurances, a key player in the Luxembourg property and personal insurance sector, also present in life insurance and savings. According to its CEO Christian Strasser, "It is vital in our corporate strategy to be able to cover our customers in every way. So we need to know their situation and needs, in order to advise them and point them in the right direction. This vision of our role matches both our philosophy and regulatory developments in our activities, designed to better inform and protect customers." For Strasser, an insurer needs to guarantee that all the insurance needs of its customers are met at every stage in their lives, personal, life and non-life insurance alike. This means having simple, rapid access to all relevant customer information.

The advantage of NETVIBES OneCall is that it is quick and easy to set up, at a reasonable cost, and covers all our needs.

Grouping all the information together

For LALUX, this challenge also involves an additional set of questions related to the existence of several information systems within the group, depending on the insurance products and the group subsidiary concerned. Although the company initially planned to roll out a classic customer relationship management (CRM) solution, in the end, NETVIBES OneCall was selected because it gathers all the customer information in one place, with the advantage that the various information systems, previously found in silos, can easily be combined.

"The digital transformation of our company is based on three points: the improvement of the front office and sales functions, the simplification of the information system and the exploitation of data," said Vincent Arnal, Chief Information Officer at LALUX Assurances. "NETVIBES OneCall means we can meet this triple challenge, because it deals with the three aspects of our digital transformation. We have positioned it as a solution for leveraging the data destined for the front office distribution network, and it has helped to optimize the information system."

The benefit of the NETVIBES solution also lies in LALUX's specific markets. In the financial services sector, and particularly in insurance, the key to success is to maintain customer loyalty and seek opportunities for cross selling, all of which depends on understanding customer behavior. Because there is little difference between products on the market, the quality of the relationship plays a decisive role.

What makes the difference with NETVIBES OneCall is its ability to aggregate data and its powerful search engine, combined with the fact that it can create a tailor-made, customized interface.

A powerful search engine

"What makes the difference with NETVIBES is its ability to aggregate data and its powerful search engine, combined with the fact that it can create a tailor-made, customized interface," Arnal said. The solution meets a need that was not covered previously, and requires few operations for enriching or reprocessing data. "It feeds itself automatically. Neither the sales teams nor those in the back office [managing insurance operations] have to enter new data, unlike with most CRM solutions," he added. In addition, the data are constantly updated throughout the duration of the contracts, and reflect changes in the personal profiles and situations of the insured. The main reasons for OneCall's success are the intuitive nature of the interface and the performance of its search engine, which is central to the solution.

The technical rollout was relatively simple. The solution’s light architecture and ease of integration with existing software are major assets. The work carried out by the consultants from Mind7 Consulting, specialized in data performance and process improvement, close to the business lines and the IT department, was another key to the project’s success. The approach adopted was based on an agile methodology. Only four months were required to configure and deploy the solution. "The software and its user interface are highly intuitive, and it was really easy to train the network, both our agents and our employees," said Steve Balance, Sales Director, LALUX Assurances.

Support and solutions

The sheer ease of use is a very important aspect for the Sales Director. One particularity of the insurance product distribution system is that the sales network is typically made up of general agents, independent company managers exclusively marketing the insurer's products. At LALUX, the users of the NETVIBES OneCall solution are mainly the distribution network and the back office.

The NETVIBES solution helps customers benefit from support, advice and solutions that fit their needs, which change with every new stage in their lives, depending on their age, family circumstances, assets and investment objectives. The platform provides an efficient local customer service, optimizing the availability of staff and agents for customers. The solution also means that they can obtain answers to their questions very quickly. Staff and partners can thus share their professional expertise, providing high quality advice and proposing products and services that meet customer requirements.

"NETVIBES OneCall provides assistance much appreciated by both LALUX employees and the agents who distribute our products," Balance said. "The solution is rapid, highly intuitive and upgradable. Before it was rolled out, three separate insurance companies within the LALUX group all used different software programs, and this translated into lost sales efficiency." The first stage of the project thus involved bringing together all the customer information in a single 360° view.

With life insurance products, the product initiator has to draw up a standardized Key Information Document for the investor. Its equivalent for non-life insurance products is the Insurance Product Information Document. Because it hosts functions and processes relating to the IDD, NETVIBES facilitates the creation of and search for these documents.

Customer satisfaction is a priority for Balance. He said that the insurance sector "depends on the ability to provide a rapid, relevant response to customers, whether contact is established through a general agent or a call center." The 360° view is crucial to obtain this responsiveness.

Building trust

Through their choice of insurer, customers express their trust in its ability to honor its commitment in terms of expertise and proximity, both closely linked to the long-term relationship it wants to build with them.

Improving customer satisfaction is a priority for LALUX; in a sector as competitive as insurance, the ability to propose products that fit customer needs is vital to creating loyalty. This is facilitated by the NETVIBES OneCall solution's 360° view of customers.

"In insurance, it's not so much the product that makes the difference, but the trust you establish with the customer," Strasser said. "Our primary concern was to have a solution that gave us the most comprehensive view possible of our customers. The advantage of NETVIBES OneCall is that it is quick and easy to set up, at a reasonable cost, and covers all our needs. We plan to go further and connect the interface with artificial intelligence by feeding data to algorithms that can address sensitive subjects like fraud and customer attrition."

About LALUX Assurances

Luxembourg's leading insurance company, created in the Grand-Duchy in 1920

Products: life and non-life insurance

Workforce: 500 direct employees and 1,500 agents

Head office: Luxembourg

More information: www.lalux.lu

About Mind7 Consulting

Specializing in performance measurement and data processing, Mind7 Consulting leverages data through information systems to respond to companies' new priorities. Mind7 Consulting builds innovative tailor-made solutions with partner developers to accelerate its customers' projects in an agile mode.

More information: www.mind7.com